Content

However, you won’t get as high a return on your investment by stashing your money into one of these options as you would be likely to get by investing it. Speaking to a financial advisor can help you decide which option will get you the most for your money while giving you peace of mind that you won’t lose everything if the market crashes. Robinhood does have limitations, though, as they don’t offer retirement accounts, or access to mutual funds or bonds.

Launched in 2010 as part of the Bank of America, it’s constantly evolving to keep its status as the best online brokerage firm. In fact, it’s undoubtedly one of the best stock brokers for beginners if you’re already a Bank of America client since opening and connecting the account will cost you absolutely nothing. Launched in 2013, Robinhood is an online trading platform designed for people with a small budget who want to try their luck on the stock market.

Opening Your First Brokerage Account

Not only did it get rid of trading stock, options, and ETF fees, but it also lowered the costs for transfers and account closures. Lannan noted the major priority among this new demographic was being able to start as small as possible and grow at their own pace. Features like zero-dollar commissions, no account minimums and fractional share investing all go a long way toward allowing investors to start as small as they feel comfortable with. This type of flexibility is exactly what Generation I is looking for in their search for the best online broker for beginners.

The Ally app, which is also used by Ally Bank, is straightforward and easy to navigate. It doesn’t have as many bells and whistles as some active trading platforms, but it has everything a beginner and most passive investors might need. Pricing starts at 0.25% of your portfolio balance per year, though you can pay more for a plan that includes access to a human financial adviser as well.

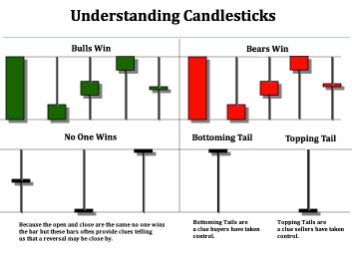

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. You might start by pulling up charts on your stocks for a graphic representation of how they trade. In the Upper Indicators drop-down menu, select SMA (simple moving average) to pull up the default 10-day and 50-day moving averages (see figure 3). Some traders use these technical indicators to identify potential stock trends. For example, you might decide to trade a stock when it rallies above one of those moving averages. Or you could draw horizontal lines on the chart to connect areas of resistance or support and then trade stocks that break through resistance or bounce off support.

Table Of Contents

Fidelity, our Best Overall Broker for 2023, is slightly easier to use, but for those just starting out we preferred TD Ameritrade’s educational approach. Here are the best investment apps for beginners as picked by Insider’s editors. Schwab is best for investors who want every potential investment need covered at a very low cost. Whatever your needs are in the future, odds are Schwab will have a solution that works for you. We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers.

- Answer a few questions about your plan for retirement and your investing preferences, and SoFi will construct a custom portfolio that divides your assets according to your risk tolerance.

- Thinkorswim has a built-in learning center that guides and educates users on key topics.

- But investing can seem scary and intimidating, especially to first-time investors.

- Throwing all your money into one company’s stock might seem like a good move, but if that company’s stock prices fall, your investment will quickly lose its value.

- For the vast majority of investors — especially the beginning investor — a discount broker is the best choice.

Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. Plus, you’ll pay another $6.99 each time you add to one of your stock positions. If you’re planning to build up your portfolio over time, it’s not hard to see how this can cost you thousands of dollars over the years. There’s no perfect broker for everyone, but here are some of the important factors to keep in mind as you’re looking for a stock broker for beginners. The term is often used interchangeably with “brokerage,” which is technically the name for a business that employs brokers or acts as a broker to facilitate trading. For example, each options contract traded on Fidelity, Schwab and Merrill Edge costs $0.65, whereas Robinhood and Webull allow options contract trades for free.

Compare Investment Apps for Beginners

But you can find some short-term no penalty CDs like CIT’s 11-month no penalty CD. CDs from federally insured banks are covered up to $250,000 per customer. Fidelity is the best investment firm for beginners, followed closely by M1 Finance.

The goal of a trader is to make predictions that will be as accurate as possible to make money, while gamblers can’t predict anything, they bet. New online trading apps have recently come under the spotlight for bringing a gambling aspect into trading. The gamification of trading, with easy-to-use online platforms, little education for retail traders and the social pressure of ‘FOMO’ also contribute to a gambling attitude on the market. Serious traders should consider their objectives, their attitudes to risk, and carefully devise an investment strategy when entering a market. Still, Moomoo has more than enough under the hood for advanced traders to get the job done. Its charting system, for instance, includes 62 technical analysis indicators and 22 drawing tools.

Those returns aren’t great, especially if you’re getting close to retirement and don’t have 40 years to grow your money. It’s also important to remember that the average rate of inflation each year is 3% or more so you may technically just break even. Before you put your money in the market, you need to have a clear plan of what you want to accomplish and how you are going to do it.

About Our FREE Investing Course

Advanced Charts, for instance, provides simple and customizable charts with a variety of technical features. Robinhood’s Options Strategy Builder simplifies the options-trading process by helping you build a strategy based on what you expect your target stock or ETF will do in the future. On top of that, it offers fractional shares, which allows investors to start buying for as little as $1. Investing in the stock market has become increasingly beginner-friendly.

You won’t pay anything to open an account and won’t incur any maintenance costs, either. Full terms, conditions and disclosures including fractional share disclosure and fee schedule at /disclosures. New customers of Public receive free stock valued between $3 – $1,000 (0.3% receive the maximum https://g-markets.net/helpful-articles/how-to-trade-the-double-bottom-pattern/ value). Finally, novice investors can rest easy knowing that their money is in good hands, as Moomoo is registered with some of the most reputable financial organizations in the industry. Depending on the type of mobile device you use, you can download the Android or iOS M1 Finance mobile app.

Since limit orders are fixed to a prespecified price, they will only fill when the limit price is reached. Limit orders are best when you know the exact price you want to buy or sell a stock. You’ll have to set up managed or automated accounts through its affiliate, Charles Schwab. While it doesn’t have quite as robust an offering, SoFi comes with several very valuable perks at no extra charge. That includes free financial planning sessions, career coaching, and other perks for SoFi members.

Best brokers for beginners in the United Kingdom

Robert R. Johnson, Professor of Finance at Creighton University in Omaha, Nebraska, is convinced there’s no better way to invest in retirement than the stock market, and no better time than now. Once investors know their timetable and the amount of risk they are comfortable taking on, they may choose to actively invest or take a more passive approach (or even combine the two). Those who have the time and desire to thoroughly research stocks may appreciate actively investing in individual stocks. There’s no reason a new investor can’t generate better returns than the S&P 500 average by investing in stocks they believe to have market-beating potential. The length someone intends to invest for will dictate a lot of their strategies moving forward.

We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team.

While you should check out the fees each one charges and get a feel for each platform before you make your decision, you really can’t go wrong with any of the major online brokers. Investing in stocks is by far the most rewarding investment option since it allows you to profit from owning any publicly traded company that you wish to invest in. My Rule #1 Transformational Investing Webinar is a great place to start investing. Especially if you’re starting to think about how to create generational wealth or you have money tied up in a retirement account like a 401(k) that isn’t growing fast enough. If you have an 18% interest rate on your credit card balance then you’d be losing more money than you can earn from investments, even at 15% average returns. Pay that down first so all the cash you can funnel into your investments is truly only making you money and growing your bank accounts.